Property and Casualty Insurance

We will provide risk mitigation and insurance services for the company !

| Property Insurance | Fire (All Risks): Office building, store and factory including its facilities, equipment, products and materials will be covered by the All-Risks Insurance. All-Risks Insurance compensates for the damage caused by accidents such as Fire, Lightning, Explosion, Wind/Snow/Hail Disaster, Falling&Flying object/Collision/ Collapse, Flood, Riot, Theft. And we also provide All-Risks Insurance for private housing and household goods. Earthquake : In order to cover the damage to buildings and contents caused by an earthquake, Earthquake Insurance is required. However, the Earthquake Insurance for Commercial property requires underwriting information and coverages are individually designed by each insurance company. In addition, the Earthquake Insurance for private housing and household goods are in default limits because of re-insurance to the Japanese government. Loss of Profit / Business Interruption Insurance: When the commercial facilities and stores suffer from a loss or damage to the subject of All-Risks Insurance, such causes as fire, explosion, water-leakage and food poisoning, it can cover up to the total profit lost corresponding to the interrupted period until the complete restoration. Movable All Risks Insurance: Products, raw materials and office goods are covered when accidents take place. And the includes accidents during loading and unloading work. Theft Insurance: Covers the loss of cash and/or securities caused by theft. And it compensates the loss and/or damage of commercial products and properties caused by theft. Machinery: Covers the damage caused by an accident that occurred to machinery in the factory and office building. And also, it covers damage of solar power generation facilities and boilers. Construction Insurance & Erection All Risks Insurance: Covers the damages to under-construction properties by the accidents related to various construction, assembly, and civil engineering. |

| Automobile & Travel &e umbrella agreement for achieving Others | Compulsory Automobile Insurance: It is the compulsory insurance that drivers are obliged to buy when they drive a car on the public roads. Automobile Insurance: Automobile insurance covers the liability of bodily injury and property damages, caused by the car accident. Companies that own multiple vehicles can expect reasonable insurance arrangements by fleet contract with all-in-one policy etc. Travel Insurance (Overseas Personal Accident Insurance, Domestic Travel Insurance) Travel insurance covers any accident starting from the door at home. Most of the companies with many overseas business travellers, buy overseas travel insurance on a blanket policy basis to seek for benefits. Personal Accident Insurance(General PA, Traffic Accident PA) : It is compensated on a straight-line basis that bodily injury, death or disability due to the accident for 24 hours in Japan overseas. Group Long-Term Disability Insurance : If injury or sickness prevent employees from working, this insurance provides them with income compensation based upon the terms and conditions on the policy. For the enterprises, as fringe benefits, we provide Group Long-Term Disability Insurance as a part of package products. Workers’ Compensation Insurance: It provides plus compensation to the Government workers’ compensation insurance for employees’ accident. Guarantee Insurance: It is to compensate for damages in the case that has been impaired in trade and employment. Inland Transit Insurance & Ocean Marine Insurance: We provide coverage for any of the following; Marine Cargo Insurance covers, while Sea / Air / Truck / Train / Post etc, all risks including War and strikes risks, War and land, Storage, Stock throughputs. |

| Liability Insurance | General Liability / Professional Liability Insurance :

General liability covers the liability incurred by the damage to a third party’s body injury and property damage. There are various kinds of special-clauses of general liability insurance depending on the business characteristics of the businesses; Professional Liability, Facility Owner’s Liability, Contractor’s Liability, Product Liability, and Fiduciary Liability etc. Employer’s Liability Insurance : It is insurance that covers the employer’s liability. In general, we arrange Workers’ Compensa. Director’s & Officer’s Liability In the business operations of the company, this insurance will cover the liability of the directors and officers who received the litigation. Employment Practice Liability: Covers the liability and legal costs due to sexual harassment and power harassment. Personal Information Leakage Insurance : Cover the costs at the time of information accident in businesses that handle customer data, including personal information. |

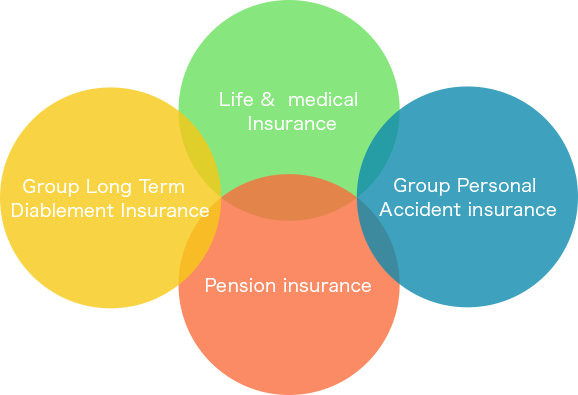

Life Insurance

We provide design and render of employee benefits and welfare plan for employers !

Insurance Arrangement for the foreign companies in Japan

We specialize in providing localized services for global companies and organizations with business interests in Japan who have global insurance programs, based on your master policies.

We are an independent general insurance agency providing international individual and group benefit plans with great negotiating power against leading health insurance companies and non-life insurance companies.

Employee Benefit

While diversification of human resources proceeds, it is possible to adjust the welfare system in which employees of each hierarchy can work with peace of mind.

And it is directly connected to motivation and economic & mental anxiety.

We will support the growth of the company through optimization of tailored benefit plans to the needs of our customers.

Effective Use of Management’s Insurances

Widen the choice with deal to the risk predicted in management of each stage of stability, and growth of the company.

■ Life and Medical each type of insurance is paid to the company

Term Life Insurance (without surrender value)

Income Security Insurance

Medical Insurance, Cancer Insurance(full payment )

■ Insurance with function of savings

Cancer Insurance (life type)

Whole Life Insurance

And we provide the Best Life Insurance for Individuals Please contact us !!

Review of the Life Insurance Contract

For your Life Insurance contracts, you can review along the following check points;

1. Insured Amount ?

Insured Amount should into survivor’s pension amount and death retirement-savings amount.

2. Insurance Period ? / Duplication ? etc

Duplication of benefits (overlapping with the accident insurance and health insurance and public insurance), unnecessary rider, insurance payments grounds and disclaimers, insurance period and the policy period, automatic coverages, etc.

3. Insurance Premiums / Premium Payment Period ?

Insurance premiums are appropriate with the current revenue?

4. Surrender Value ?

Cash surrender value amount, the current interest rate?

5. Beneficiary ?

Beneficiary designation, insured, beneficiary designation

For more details on products and services available, please contact us we will provide the Best Life Insurance Planning for you

Insurance Company

NON-LIFE INSURANCE

Chubb Insurance Company

Capital Insurance Company

Mitsui Sumitomo Insurance Company

Aioi Nissei Dowa Insurance Company

LIFE INSURANCE

MetLife Insurance Company

Sompo Himawari Life Insurance Company